When thinking about what to expect from new CEOs, people tend to pay attention to prior work history and accomplishments. In this article, Dev Patnaik breaks down the five types of CEOs and how their unique mindsets—more so than their resumes—speak volumes about how they’ll navigate growth challenges now and in the future.

Several years back, I was asked by a friend to have lunch with the CEO of a large media company. In preparation for our meeting, I asked some of my teammates at Jump to bring me up to date on the industry. I also spent time studying the work we had done on the Future of Entertainment. I wanted to know how technology and consumer behavior were shifting. All of this was in the hopes of being helpful to the CEO.

But when the day arrived, most of that preparation proved irrelevant. The CEO wanted to spend most of our time talking about interesting deal activity in the media sector. He’s a great storyteller and he explained to me why the CBS/Viacom merger had been such a brilliant deal. It turns out that before it had become Viacom, Paramount Pictures had been part of Gulf + Western, an oil company. And it had been forced to inherit a number of bad assets from that conglomerate. In fact, Viacom had been one of the largest owners of “Superfund” toxic waste sites in the country! That liability was always depressing the value of the enterprise. And there was no way to get rid of it. Until CBS came calling. Because CBS was really the old Westinghouse business, an industrial company that had bought the Tiffany network a few years earlier. By merging with CBS, Viacom could combine its industrial assets together and spin off Westinghouse. And Viacom would be finally free of its dirty oil assets! The result would be a clean balance sheet for the newly created media company and an elevated price for shareholders.

I was fascinated and more than a little humbled, if only because I was completely out of my depths. I had come to lunch to talk about the future of movies and television. And I walked away having received a masterclass in managing a balance sheet.

What I also learned was that there are very different kinds of CEOs in this world. And while some of them care about their products or their customers or their company culture, others see their businesses primarily as a portfolio of assets.

I share this story because it points to a fundamental difference between business leaders. It’s a difference that we all should be paying more attention to: that of CEO mindset.

When it comes to large company CEOs, we’re in the midst of a massive changing of the guard. Between January and September of last year, over 1,400 CEOs of U.S. companies stepped down. That’s a rise of almost 50% from 2022, according to one report. A recent Deloitte report found that nearly 70% of CEOs are considering quitting. And they’ll need to be replaced.

Looking for clues of what they can expect from new CEOs, people will pay attention to prior work history and industry trends. Just like I did. And they won’t pay attention to mindset. Of course, a leader’s past accomplishments matter, but by focusing too heavily on what a leader has done, they risk missing the crucial factor of why they did it—the mindset through which they make meaning of the world. It comes down to what they think being a CEO is all about.

Some of them think they ought to focus most on the culture of the organization they’re leading. Others want to make sure that their company is producing great products. And still others are like my new friend. They care first about the balance sheet.

The banker CEO is laser-focused on maximizing shareholder value through acquiring new assets or selling off underperforming businesses. They can be excellent leaders for companies that need to clean house by unlocking value from assets or offloading dead weight. But they might not be strong at future-proofing the company or creating new value. Warner Bros. Discovery CEO David Zaslav has shown his banker mindset by focusing on selling off assets and cutting costs. It’s unclear whether that’s the right mindset for a company that’s crying out for a new business model.

The salesperson CEO views success as coming from the latest new partnerships or big customer contracts. A common breed of leader in big IT services firms like Accenture or Infosys, the salesperson CEO can be the right leader for companies that need to expand market share and revenues. Less so for businesses that need to fix fundamental problems like organization and culture, or even long-term technology investment.

Oops! We could not locate your form.

The manager CEO sees success through the lens of setting objectives and building a strong culture. The org chart and the list of KPIs are this leader’s touchstones—it’s all about getting the right people in the right seats working on the right goals. Ken Chenault of American Express and A.G. Lafley of P&G were classic managers, and the new Starbucks CEO Laxman Narasimhan is shaping up as one too. This mindset is great for steadying the ship of a company that has lost its way on culture and organization, but there may be blind spots when it comes to addressing long-term or hidden threats.

For the technocrat CEO, the key to success is making great products that people love. Common in the tech and CPG industries, this CEO archetype (personified by Google’s Larry Page) cares most about the product pipeline and how well their offerings meet customer needs. This mindset is best for companies that need to refocus on customer centricity and product innovation, but it may not work for those that need to allocate resources to boost enterprise value.

And then there’s the most interesting type of them all.

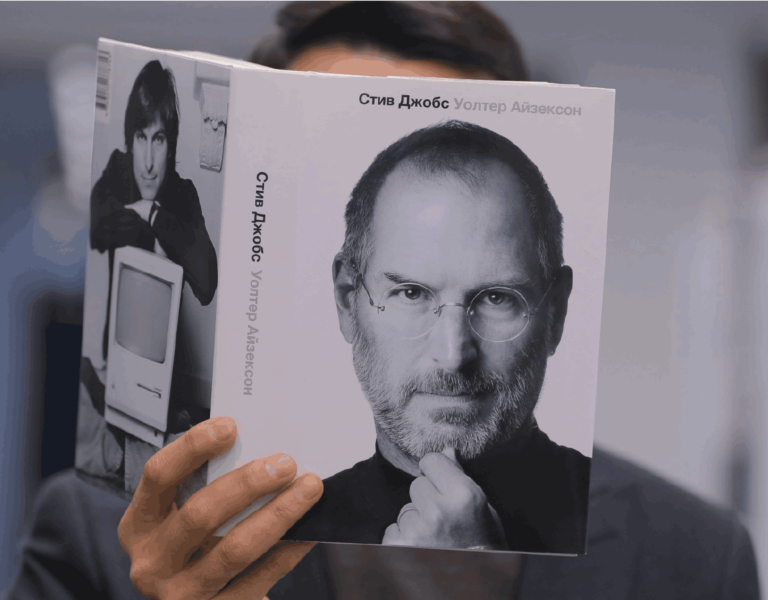

The founder CEO is a beautiful hybrid—a leader who identifies with a company at a deep, personal level and who cares intensely about its long-term future. A founder can be a combination of technocrat, salesperson, and manager who can invent, transform or re-invent an organization. Typically, companies don’t choose their founder CEO, but they can sometimes bring them in to “re-found” an organization and get it back on track to greatness. That’s what happened when Jobs returned to Apple. A founder CEO doesn’t have to be the literal founder of a company. Howard Schultz didn’t found Starbucks but he was the one who made it what it is and to whom the company turned for a second act as CEO when renewed transformation was needed.

I recently went back to watch Apple’s original iPhone launch from 2007. That presentation will go down as a great moment in history. The iPhone literally changed everything. But because there were so many CEOs on the stage, the event is a great display of different mindsets at work.

Eric Schmidt from Google was the ultimate manager. He devoted most of his remarks to praising the close collaboration between Google and Apple engineers. Jerry Yang, the head of Yahoo, was most pumped about the Yahoo app and the iPhone’s technical features. He was the product guy: the technocrat CEO. Then came Stan Sigman, CEO of Cingular. Sigman spent most of his time talking about the merger he had closed between Cingular and AT&T. He’s clearly a sales guy at heart. And presiding over all of it was Steve Jobs: the archetypal founder. Steve spent a good amount of time talking about what the iPhone meant for Apple as a company. The phone was his baby. But more so was the company. At points in the launch, it seemed like each of these CEOs was talking past the others. Because they were.

Mindset matters, whether you’re a board member, an aspiring CEO, or an employee. Boards need to think deliberately about the mindset needed for the key challenges the company will face in the coming decade. Every leader needs to consider whether their mindset is a good match for the organization they’re seeking to run. And every employee should be attuned to their CEO’s mindset to know what to prioritize in their own jobs.

To be sure, most CEOs possess elements from all these mindsets. But one of these five is most dominant in them and shapes the lens through which they lead. That’s why companies need to be acutely aware of the mindset they’re buying into with their next CEO. It’s the difference between being prepared for the future and getting mired in the past.

This article appeared in Forbes on March 3, 2024.

Dev Patnaik

Dev Patnaik